Coronavirus Live India: Northeast and South India Leading In Containing COVID-19 Spread

- 30-04-2020

- News

Borrowing a loan is a normal process for everyone. You go to the bank and they offer you the loan, you agree to the terms and conditions, get an idea about how much interest you have to pay to repay the loan, put something as collateral and you get the loan. This situation changes sometimes when banks refuse to give you a loan because they don't get the assurance that the bank will get their money back.

This situation worsened during the pandemic when from a daily wage earner to a business, everyone needed the loan. Market went down, businesses went down, private sector employees suffered a lot in this period. They needed the loan for their monthly expenses but banks due to tight norms and low market conditions were not really keen to offer loans. The repayment capacity of people had fallen down and banks didn't want to increase their NPA(Non Performing Asset) in their balance sheet and run into losses. Chinese companies waiting in the ambush came in front of people to perform a nasty fraud.

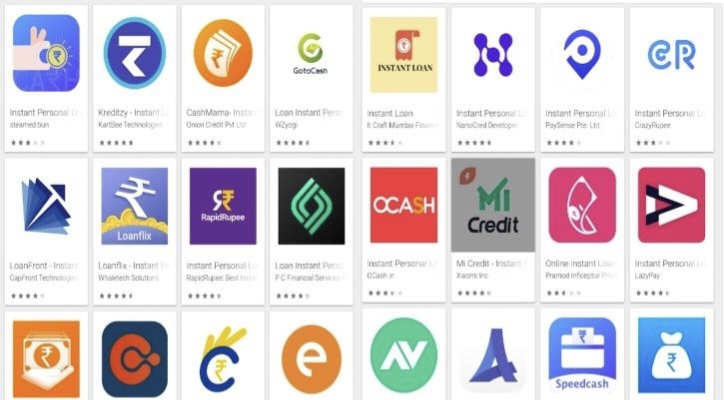

Many Chinese apps start offering loans to people. These apps didn't disclose their terms and conditions very well. They didn't mention what permissions they are taking and what kind of data they will collect. Needy Indians who badly needed money to survive, got trapped in this scam.

Instant loan in hand -

There are many fintech companies that provide small loans in India. These loans generally have small amounts and repayment is in 7 to 30 days. Such small companies offer low loan interest rates and with less paperwork required, people feel it easy to get loans from such apps. These micro-loans giving apps increased drastically during the pandemic as the demand increased. Some of the Chinese apps took advantage of the situation and started copying personal data of users with opaque terms and conditions. These Chinese apps got full acees to user's phone and then their recovery agents harassed customers to that extent that some suicide cases of the app users have been reported.

These apps firstly offered loans with low interest or no interest in several cases, people happily accepted the terms and conditions without worrying much. People thought that they got an excellent deal where they will be paying little interest and it will solve their problems. However, after accepting the terms and conditions and granting permissions to the app. The app credited the loan in their accounts. These Chinese apps then started demanding repayment of the money. They stole the documents, videos, photos, chats and copied the phonebook from the phone of users. They distorted the image of app users into objectionable images and sent it to their contacts to defame them. With the personal information, they started harassing users to repay the loan that too not on a low interest rate as they thought, many of them end up paying 66% interest rate. After copying the phonebook, these apps started calling the person's relatives and friends and told them that they need to repay the amount on behalf of that person as they are the guarenter appointed by the user. After collecting the money from users, these Chinese apps converted them into cryptocurrency to send it to China. These complaints of these Chinese app users reached the Bengaluru police and 18 FIRs have been lodged in this regard.

The Enforcement Directorate(ED) raided many locations in Bengaluru to find key people related to these apps. ED is looking for linkages with apps like Cash Free Payments, Razorpay Private Limited, Paytm Payment Services Limited as these are the suspected apps which are being controlled by China.

The entities that were running these apps had bank accounts which are now being seized by ED. ED has also taken over their merchant IDs and recovered Rs.17 crore from them. As per the investigation agency, the people caught in this regard are just the dummy directors and the real functioning is being done in China. These apps controlled and operated by China raise suspension about the motives.

How to save ourselves from these frauds?

As an aware user, you can do following things to prevent such things with you-