Next-Gen ASUS ROG Phone 3 is coming very soon, Here is the specification of Asus ROG Phone 3

- 25-06-2020

- News

As of July 28, 2020, Reliance Industries Limited (RIL) chairperson, Mukesh Ambani became the fifth richest man according to the Forbes Real-Time Billionaire list with a net worth of US$81.6 billion. This is owing to the share price of his conglomerate hitting an all-time high after the recent announcement of RIL becoming ‘net-debt free’ ahead of its erstwhile timeline of March 31, 2021.

This news came soon after Yes Bank took possession of three properties of his younger brother Anil Ambani’s Reliance ADA Group (ADAG) on July 22, 2020, due to non-payment of dues worth Rs 2,892.44 crore.

Such a vast difference in the financial status of two brothers who once used to operate jointly under their father’s Reliance Empire, makes us take a sneak peek into their journey after the split.

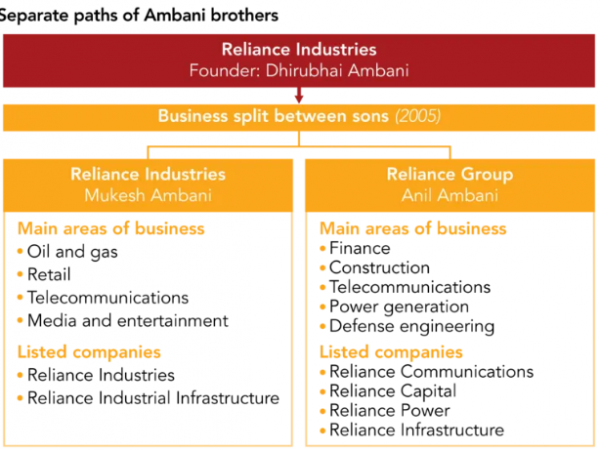

Brief of Reliance group and split

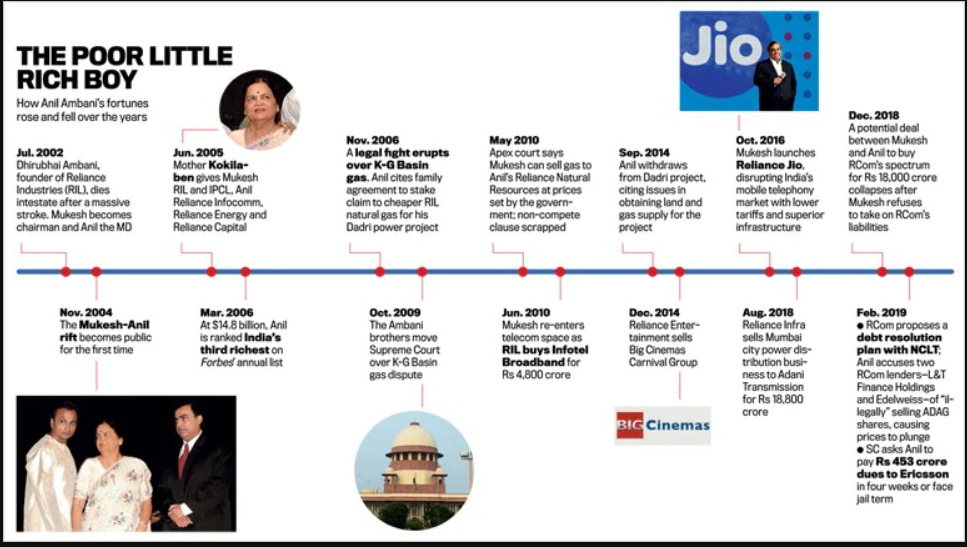

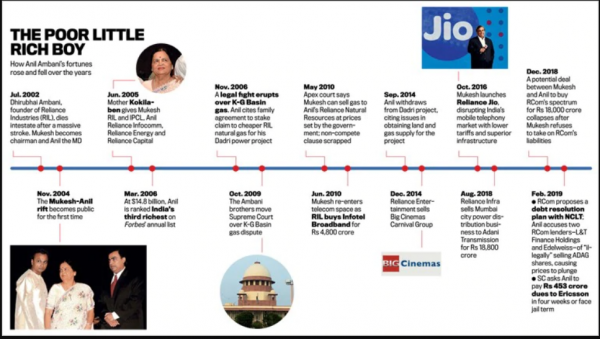

Reliance Industries founded by DhirubhaiAmbani in 1960 was split between Mukesh Ambani, the elder son and Anil Ambani, the younger one, after his death in 2002 sparking a bitter family feud. The two brothers distributed the empire in December 2005 with Mukesh Ambani getting Reliance Industries and IPCL and Anil Ambani receiving telecom, power, entertainment, and financial services business of the group. Anil formed Reliance ADA Group in 2006. At the time of split, the wealth gap between the two brothers minimal. According to the Forbes Rich list 2007, Anil's net worth was $45 billion while Mukesh held assets worth $49 billion. But now after 13 years, the growth trajectory of the two brothers followed completely different paths and younger brother is no more a billionaire.

[Image Source: Nikkei Asian Review]

Reliance Anil Dhirubhai Ambani Group (ADAG) – what went wrong?

In the last two decades, the Anil Ambani’s group expanded aggressively in new businesses that provided quick returns raising high levels of debt. The junior Ambani saw immense growth in wealth in the initial stages but by 2014, trouble starting brewing in the paradise. The group's fortunes kept declining with businesses not generating enough cash flows required to repay the debt thereby getting mired in legal disputes, bankruptcies and stake sales. Some noted ones are:

NCLT will decide on August 5, 2020 if UV Asset Resolution Co Ltd (UVARCL) and Reliance Jio Infocomm (Jio) are the buyers of RCom’s assets.

[Image Source: India Today Magazine]

By 2019 things got so bad for Anil, that he was threatened with jail if he did not pay dues to Ericson. However, Mukesh plunged in for rescue by clearing the dues on Anil’s behalf. Anil is now gradually unwinding his debts and refocusing the firm toward real estate. On June 23, Anil Ambani claimed that Reliance Infrastructure, which has loans outstanding of Rs 6,000 crore, will be completely debt-free in 2020-21. Reliance Group firms is blamed as among the key reasons for the high amount of bad debt piled up by Yes Bank having an exposure of over Rs.12,000 crore. The bank recently took possession of the headquarters of ADAG in Mumbai, for non-payment of dues.

Reliance Industries Limited (RIL) - The rise of Mukesh Ambani

Mukesh Ambani’s RIL owns businesses across India engaged in energy, petrochemicals, textiles, natural resources, retail, and telecommunications and recently became the first Indian company to exceed US$150 billion in market capitalization making him the only Asian to make his place in the list of top 10 billionaires of the world. Mukesh is known for doing things the right way and believes in doing business at larger scale owing to which he made a series of investments and acquisitions in a span of 13 years. But his love persisted with his brainchild Reliance consumer telecom business which for some reasons went to Anil at the time of split.

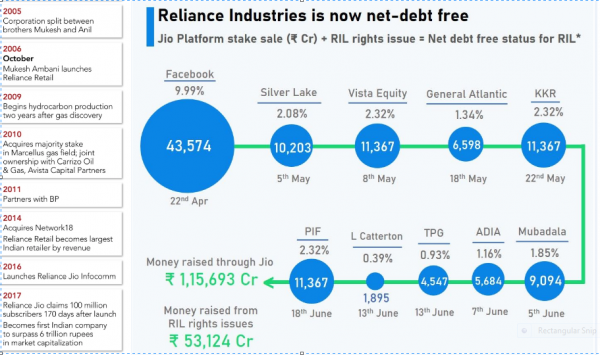

Once the non-compete clause in the agreement to split got scrapped, Mukesh launched Reliance Jio in 2016 which proved to be the biggest blow to Anil’s already ailing RCom. With huge investments in the telecom sector, RIL’s net debt soared to Rs. 1.61 trillion ($21 billion) in March 2020.

Mukesh Ambani went on a fundraising spree over next three months and raised $15.2 billion by selling Jio’s equity stakes to 12 global investors ranging from foreign tech giants like Facebook to private equity and sovereign wealth funds. These investments, along with $7 billion raised through the country’s largest rights issue, helped RIL become net debt-free much ahead of its anticipated deadline.

[Image Source: Nikkei Asian Review and FINSHOTS/MARKETS]

Net debt-free status doesn't mean RIL has no debt in its books, it means that it has enough cash to cover for its debts and is less risky from an investor's point of view. With straining U.S.-China relations, the Reliance Empire can be a viable option for global investors. At this time, when most of the Indian business groups are reeling under the impact of pandemic and are under hefty debts including his younger brother, Mukesh’s RIL is a ray of hope for Indian government to achieve its vision of ‘self-reliant’ India.